Newsletter

Newsletter

The end of the Platform Era provides an important lesson for publishers that they can’t rely on the strategies of others for their success.

25th May 2023

In the Pugpig weekly media bulletin, Pugpig’s consulting services director Kevin Anderson and digital growth consultant James Kember distill some of the best strategies and tactics that are driving growth in audiences, revenue and innovation at media businesses around the world.

By Kevin

This week, I had the honour of speaking to an international group of journalism leaders at the University of Central Lancashire’s Journalism Innovation and Leadership Programme. When deciding what to talk about, I realised that we were in one of those rare periods when it is clear that one era in digital publishing has clearly ended and another is beginning. The Platform Era is ending, and the AI era is just beginning. The Platform Era wasn’t just marked by a period of easy traffic from social platforms but also by a series of investments initially from VCs and legacy media companies and then through SPACs. Those investments pushed the companies to seek growth at any cost, and platforms provided that audience growth.

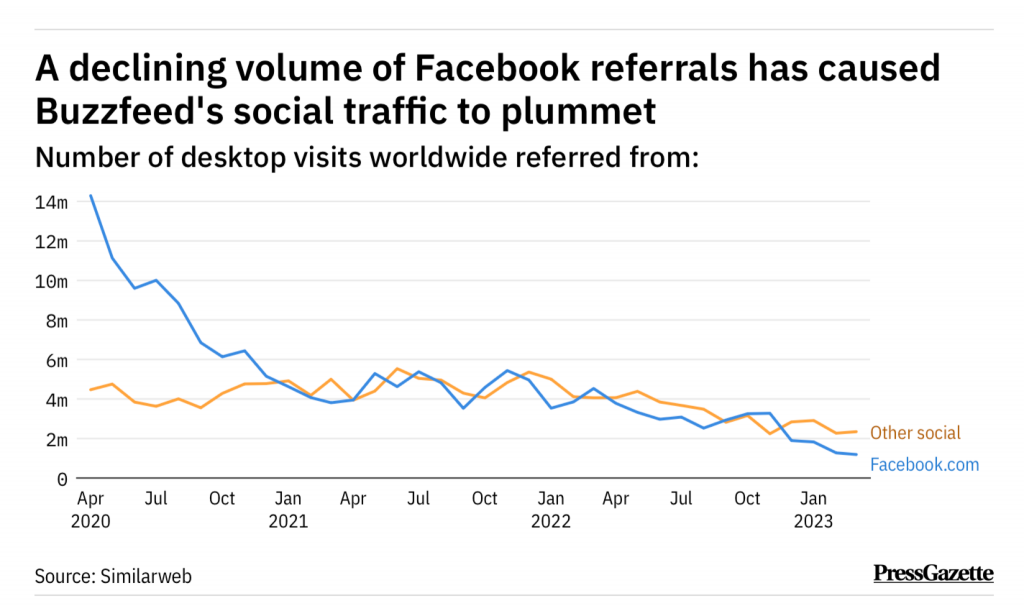

While the collapse of BuzzFeed News and the bankruptcy of Vice might be the event that led to the obit for the era, this has been a slow motion car crash. The beginning of the end of this story began all the way back in 2017 when Mashable sold for $50m, less than a year after an investment from Time Warner’s Warner valued the company at $250m. Then Bustle bought millennial-focused site Mic also at a firesale price after a pivot to video floundered and funding from Facebook fell through. Mic had at once been valued at north of $100m but sold for $5m. When it sold, its revenue had been flat at $14m, and its traffic had been dropping. That was the beginning of a wave of consolidation in the digital media sector. And then Facebook pulled the plug on the players that remained.

A journalism leader from Africa asked me how they should handle overtures from platforms, and after a few days of thinking about the question, I would say the lessons are this:

It’s important to remember that other media companies – the New York Times, the Financial Times, the Independent and many others – have found success with different strategies than these digital players who chased scale using a playbook that was overly reliant on social platforms. Instead of relying on masses of anonymous users only loosely connected to their brands, they have built businesses and brands based on known users and subscriptions. Last year, the New York Times gained more than 1m digital subscribers despite the overall economic uncertainty, and the FT’s digital transformation now powers not just their publishing business but also a growing consultancy. The strategies have a few things in common while also having some characteristics unique to each organisation:

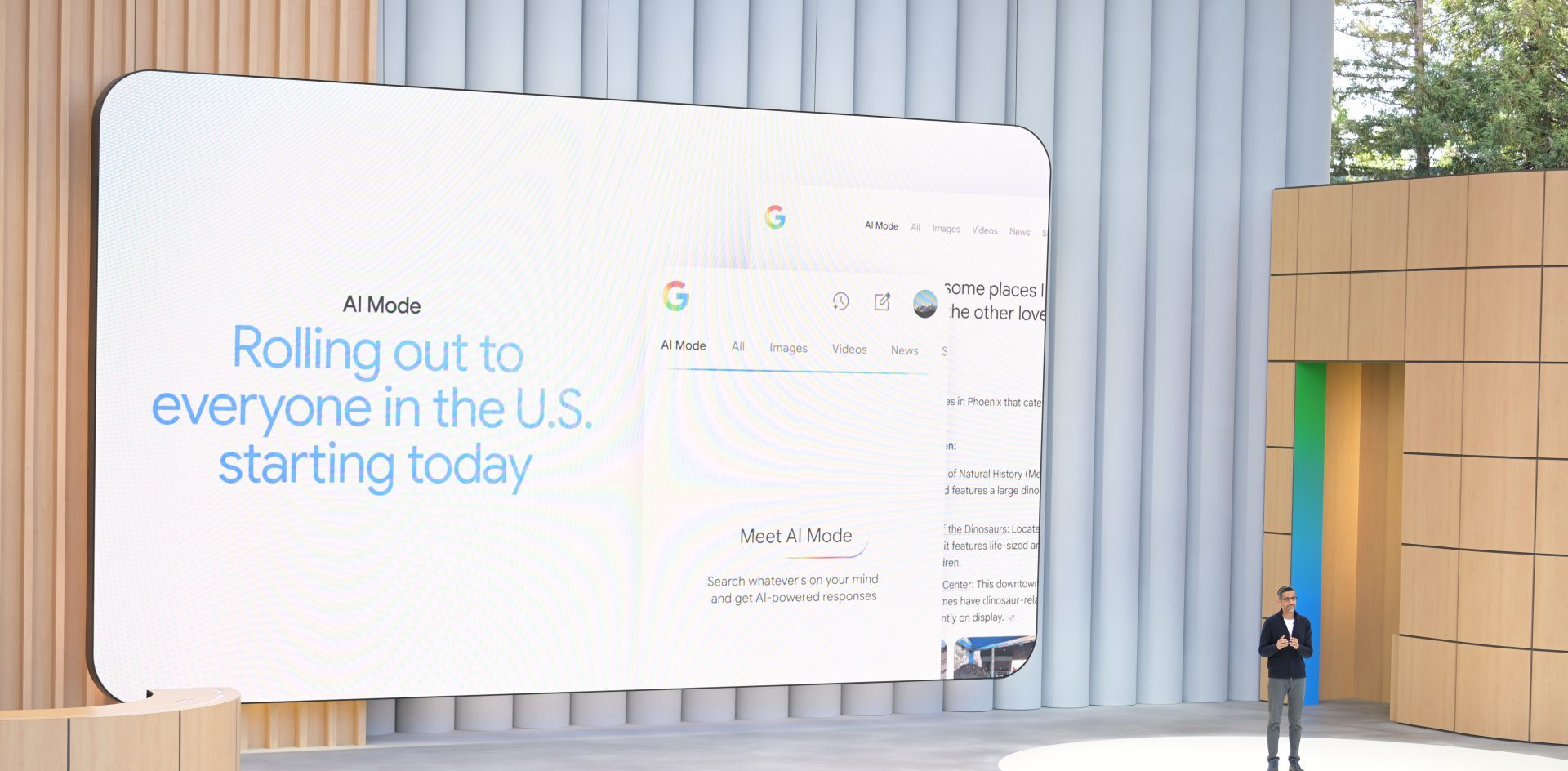

This pivot is a good time to take stock as the Age of AI gathers momentum. One of the things that led to the over-investment in platform-focused digital publishers was a sense that they would build the media empires of the 21st Century. In the end, the platform-focused publishers didn’t build valuable media brands or sustainable businesses. Instead, they developed a strategy not only based on a moment in time but also based on the strategic direction of other companies. When Facebook pivoted, they pivoted. They spent more time trying to figure out the black box of Facebook’s newsfeed algorithm rather than figuring out what their audiences wanted. Virality rather than regularity was their KPI, and the traffic peaks never lifted these companies to new plateaus and sustained growth.

In the meantime, some traditional publishers, in news and magazines, around the world decided to focus on developing their own strategies. Yes, they leveraged the audience growth potential of platforms, but it was in the service of building awareness of their brands and drawing audiences that they attracted using social media into a deeper relationship with them that would lead to registration and a membership or subscription relationship. They decided against relying on a relationship with their audience mediated through another company. And the data they have because of these relationships with their audiences will provide a durable competitive advantage for these companies in the Age of AI.

By James

Last Friday Comscore released their State of Digital UK 2023 report, which looks at how the UK population is consuming digital media, with a focus on the role of social media. This is particularly relevant in the context of last week’s Media Bulletin where we discussed the end of social platforms as a driver of volume traffic to publishing brands.

Here are some of the key takeaways from this year’s report.

Whilst over 2 in 3 users are on both desktop and mobile, just 7% of users are desktop only, with under a quarter only on mobile. Despite this, the volume of engagement between desktop and mobile is skewed heavily. Over 80% of online time spent by users is attributed to mobile devices, with only 1 in 5 ‘digital minutes’ being attributed to desktop.

Mobile browsers and apps are pretty consistent in the number of unique users: apps had 44.5m monthly uniques to 43.4m on mobile web. But engagement with apps is significantly higher. The report calculates that time spent on apps is 5.5 times higher than mobile web. This aligns with what we see regularly at Pugpig when carrying out analytics for our consulting clients; engagement on the app is significantly higher than on the web. This is allowing our publishing partners to leverage their apps as tools to increase their audience’s engagement with their content, driving habit and loyalty that lead to enhanced conversion and retention.

Numbers in the report showing Gen-Z favouring TikTok over Facebook won’t be a surprise to anyone. For 18 to 24 year olds, Facebook does not feature in their top 3 social platforms for reach, with TikTok taking top spot followed by Instagram and Reddit. However, for older age groups it’s a different story, with Facebook in first place for both Millennials and Gen X: it is able to reach 84% of 25 to 34 year olds and 93% of over 35s. For those audiences that originally engaged with Facebook in its heyday remain connected with the platform. Significantly though, no single platform has similar levels of reach for Gen-Z. Even TikTok is only speaking to 70% of the youngest cohort.

We know that Facebook is no longer a key driver of cheap news traffic to sites, but as a marketing tool it should maintain a place in publishers portfolio when it comes to running paid campaigns focusing on activities like subscription acquisition and audience retention.

The volume of video consumption is up 30% year-on-year across desktop and mobile. This has been partly driven by shorter format content, with Instagram reels, TikTok videos and YouTube shorts increasing annually by 188%, 275% and 632% respectively.

Publishers have been leaning into this, with around half now regularly publishing content on TikTok, according to The Reuters Institute. But it remains a challenge with limited revenue opportunity and no direct way to monetise content. Whilst some publishers are viewing TikTok as a way to connect with younger audiences, some like the New York Times are generally opting to stay away.

The reach of online news remains huge. According to Comscore, 94% of the UK audience access news sites, and there are some good signs for some local publishers as well. Of the top 10 largest local news sites six have seen year-on-year audience growth, with visitors to the Nottingham Post soaring by 87%. However, the picture is mixed, with the UK’s three largest local news brands, The Manchester Evening News, Liverpool Echo and Daily Record seeing declines in traffic of between 2% and 5%. Moreover, advertising headwinds continue, and generally, smaller news sites are less able to monetise their audience through subscription models. Audience growth is good, but it’s not a guarantee of success or sustainability.

Overall, the themes identified by Comscore are further evidence of several trends in the publishing industry. Having a mobile-friendly site is essential, but real engagement comes from building an app. Social reach remains high but it is difficult for publishers to monetise, be it TikTok videos or news content within Facebook. The good news is that news sites remain an essential part of the digital diet of the vast majority of the UK population.

At Pugpig Consulting we’re working with partners to build great products that help to increase engagement and regular use. If you would like to discuss how we can help you, get in touch.

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter

Newsletter