Newsletter

Newsletter

Publishers will need to re-write audience acquisition playbooks, grow ARPU and invest in first-party to meet the challenges of 2024.

12th January 2024

In the Pugpig weekly media bulletin, Pugpig’s consulting services director Kevin Anderson and digital growth consultant James Kember distill some of the best strategies and tactics that are driving growth in audiences, revenue and innovation at media businesses around the world.

If you want to know more about how we are working with publishers like you, get in touch at info@pugpig.com.

2023 was a tough year for publishers with the collapse of traffic from social platforms and struggles to retain the subscribers they attracted during the pandemic-driven boom. Many publishers are now looking to 2024 as the year they get back on the front foot. They are planning to build more direct relationships with their audiences, expand the use of high-engagement formats and try to re-ignite reader revenue growth. It is a year which includes elections in several major countries, not least the UK and the US. For news publishers, this creates an opportunity to harness increased interest in news to build larger audiences and develop engagement.

But it’s going to be a challenge. Nic Newman at the Reuters Institute for the Study of Journalism recently released his annual trends and predictions report based on interviews with 300 media leaders from more than 50 countries and territories around the world. In those interviews, he identified that less than half of the leaders – editors, CEOs and digital executives – (47%) say they are confident about journalism’s prospects this year, and 12% say that they have low confidence.

Nic’s survey echoed themes from a piece by the Press Gazette just before Christmas, which spoke to 18 media leaders about what they see as the biggest challenges that the publishing industry will face in 2024. The need to build direct relationships, the ever-shifting advertising market and the importance of trusted news sources in the era of AI, featured heavily in media leaders’ comments.

In Nic’s survey, media leaders expressed anxiety that the steep declines in social media referrals could continue in 2024. Chartbeat shows that traffic to news sites from Facebook is down by 48%, and two-thirds of the leaders that Nic spoke to said they are concerned about this sharp decline. However, when talking to the Press Gazette Julia Beizer, Bloomberg Media’s Chief Digital Officer had a hopeful message. “We can choose to see this as yet another blow handed to the industry by big tech – or we can see it as an opportunity,” she said.

What is the opportunity? For Julia, the platform era “robbed us of loyalty”, and it is now the time to lean into direct relationships to build up engagement, rather than focusing on acquiring new audiences.

To achieve this there are several important factors to consider. The product needs to be of high quality, across the web and the app. The approach to content should be audience-centric, with personalisation where appropriate. And, as we spoke at length about in our Retention Economics Report last year, engagement will reduce churn, but the approach must start at the very beginning of the relationship, as Die Zeit found with their “First Day Subscription” retention programme. The first couple of days are crucial to deliver long-term value and strategies such as onboarding need to be tested and tailored.

Although, however good an audience retention strategy is, it’ll always be a leaky bucket and the need to acquire new audience groups will remain valuable. Business Insider Global Editor-in-Chief Nicholas Carlson had an interesting take, suggesting that media brands can achieve this if they remember that they “don’t want to be a publication for everybody”. Acquisition efforts need to be a lot more focused than before. It’ll also require a higher level of investment. However, Nicholas is also highlighting the importance of brand proposition. In the platform era, the focus was on attracting masses of loosely connected readers to drive advertising revenue. However, as so many media brands found. This didn’t lead to brand awareness, much less loyalty, and the platforms captured almost all of the revenue. Who is your audience? What are their needs? And what is the best way to develop awareness that leads to engagement?

For Reach’s Chief Digital Publisher David Higgerson, new audience acquisition was of primary importance. David cautioned the Press Gazette about an approach that only focused on the “naturally hyper-engaged” and instead suggested a focus on reaching the “30% of people who claim to be regular news avoiders”. For David, the acquisition of new audiences remains central to their strategy.

A split remains between publishers. In the past, we presented this as the volume versus value. Volume publishers pursued the platform-driven approach, while value publishers pursued a product-led growth strategy rooted in developing content and content experiences that delivered sufficient value for audiences that they were willing to pay for them. Some publishers seem so disillusioned with platforms that they are investing in their owned platforms in 2024. Those publishers are leaning into high-engagement formats including newsletters, video and audio. Others Nic surveyed are balancing the owned platform approach with experiments on new platforms including TikTok and WhatsApp. Ultimately, at Pugpig Consulting, we see a much needed re-balancing. Yes, off-platform brand awareness and acquisition still have a role to play, but it has to be understood that off-platform KPIs – follower counts and platform impressions – need to be balanced with KPIs that measure how this leads to deeper relationships with your products that lead to engagement and ultimately revenue.

Advertising was soft in 2023, and 80% of those surveyed by Nic Newman will continue to invest in subscriptions and membership, more than either traditional display or native advertising. However, in 2023, we heard from publishers of an awareness that much of the low-hanging high-ARPU subscribers had been converted. As we argued in our Retention Report, publishers will need to maximise ARPU not only amongst subscribers but also more loosely registered customers, some of whom will never pay for a full subscription, and other known and unknown users. This will require creative thinking about new products, bundles and business models.

Although there was a modest growth in advertising spend in 2023, this was almost entirely absorbed by the tech platforms. The challenges have not eased for publishers.

Despite the headwinds, when Chrome finally depreciates third-party cookies in the second half of 2024, this will present an opportunity for certain publishers. It is likely that once again, context will be king and industry or sector-specific publications, such as fashion or automotive magazines stand to benefit. But what does it mean for more general news brands? Well, those that have a mature audience strategy are in a stronger position. As Future’s Global Ad Product and Revenue Operations Director Nick Flood told the Press Gazette, this means that “agencies and advertisers are going to struggle to find their target audiences across the open web”. Likewise, the Guardian’s Chief Executive Anna Bateson promoted publishers showcasing their “unique formula”, which for the Guardian meant a combination of “scale, influence and integrity”.

This will also mean that registration strategies, so often viewed only as the gateway to subscription, will have a clearer role to play in advertising. Moreover, there will be an increasing role for publisher-owned technology that maps digital behaviour to build segments and profiles. And in the INMA conversation that we highlighted last week, publishers are also looking to improve their advertising products for subscribers. At Future, they are looking to their audience data platform, Aperture, to deliver sophisticated targeting solutions. Nick Flood advised other publishers to consider a similar first-party solution.

AI has the potential to be the biggest disrupter to the publishing industry since the birth of the internet. Almost all of the media leaders that Press Gazette spoke to agreed on some level of the need to be prepared to address the challenges and opportunities of AI. Broadly speaking, these fell into two categories. Firstly, the danger that AI presents in terms of scraping content and absorbing traffic and attention, and, secondly, the risk that inaccurate AI-generated content destabilises elections.

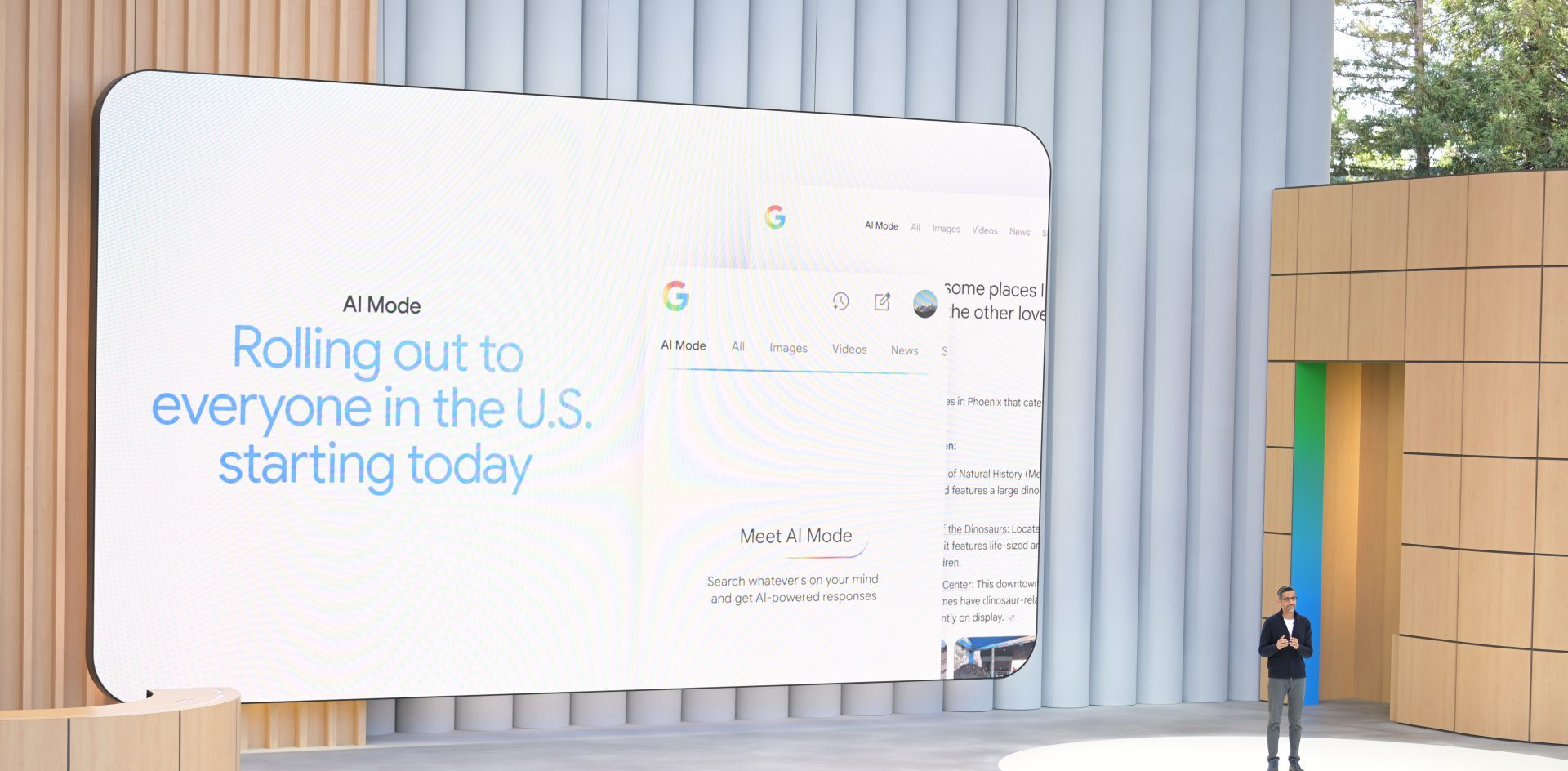

AI could be the final nail in the coffin for free traffic through to publishers’ sites. Although Facebook traffic numbers have fallen off a cliff for most publishers, Google has remained a reliable source of traffic to publishers. Indeed, for many publishers, this source of users has become more significant and we’ve seen from some of our Pugpig consulting clients the benefits of articles featuring in Google News or Discover. Nic highlighted publishers’ concerns about Google’s search generative experience. It will provide answers to users’ questions directly in search results, leading publishers to worry if users will get enough information without continuing to their sites.

Scott Purcell, co-founder of Australian men’s lifestyle site Man of Many, pointed out the problem to the Press Gazette. He said that AI will pose a “significant challenge” to publishers’ traffic, as it will make it harder for “publishers like us to compete and stand out.”

However, disruption also creates opportunity. For Scott, he sees it as a chance to “double down” on “creating quality, original, and people-first content”. This will force “Google’s systems [to] evolve to detect better and highlight such content”. Similarly, Hearst UK Chief Executive Katie Vanneck-Smith said, that “we also need to encourage our editors to be braver”. For both Scott and Katie, this will produce content that AI “can’t replicate”.

Moreover, in the biggest election year in history, there will be an increase in the number of people hungry for news. And reliable, accurate journalism will play an increasingly important role. ITN’s Chief Executive Rachel Corp, pointed out that “Elections are a really exciting time for any newsroom, but we need to ensure that technological developments such as generative AI don’t negatively impact the trusted and impartial reporting that we know audiences turn to us for.” There was a similar message from The Sun’s Director of Digital (Editorial), Will Payne who said, “In a world of mass AI-produced, low-value content, quality journalism will be at even more of a premium than it has ever been.”

But publishers’ views about AI aren’t all doom and gloom, and the Press Gazette highlighted the opportunity for AI as an enabler for media organisations. The Sun’s Will Payne pointed out that if they can use AI to improve newsroom workflows that would free up journalists to focus on producing content. This aligned with Nic’s Reuters Institute where he reported that a majority (56%) of publishers were looking to leverage AI for back-end news automation, with other applications for AI including better recommendations (37%) and commercial uses (28%). That being said, while 2023 ended with Axel Springer striking a big deal with OpenAI, half of those surveyed thought that little money would come from AI companies for licensing. And almost a third thought the major cash would go to big players like Springer.

2024 holds risks, but publishers see opportunities as well. The steady decline of traffic from social media will mean that audience engagement strategies need to mature quickly and acquisition playbooks have to be rewritten. The depreciation of the third-party cookie will force advertisers to change tactics, and only those publishers with an established audience strategy, or strong contextual offering, will be able to mitigate the potential impact to digital revenue. And the evolution of AI, in the context of a year of much democratic change, will mean that publishers will need to double down on original, high-quality content. This will both uphold the importance of journalism to democratic societies and mitigate the impact of AI scraping or generating inaccurate content.

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter

Newsletter