News

News

Key takeaways from David Buttle’s session ‘Reaching & Engaging Audiences in the age of AI’ at the Pugpig Customer Summit 2025

17th December 2025

At the 2025 Pugpig Customer Summit, David Buttle – former FT Director of Platform Strategy and a strategic advisor to publishers navigating AI disruption – gave a candid briefing on what AI means for search, discovery and business landscape in 2026 and beyond.

Across the session and Q&A, he pulled out data from OpenAI, Google and Chartbeat alongside real-world observations from his work with publishers. He gave a clear and, at times, stark picture of how the discovery landscape is shifting, and what publishers must prioritise to protect audience value.

We’ve distilled the key takeaways from his session, which you can also watch in full.

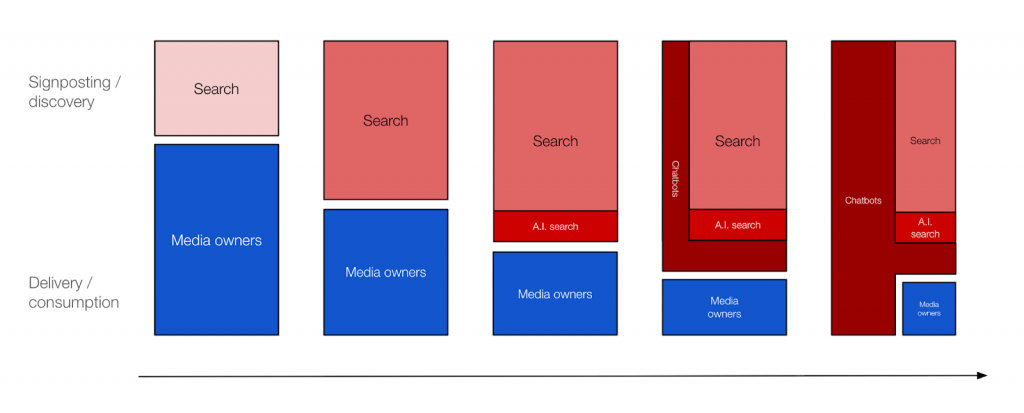

Buttle opened with a simple but powerful visual: a diagram showing how the “surface area” available to publishers is being progressively squeezed by zero-click search results, generative AI overviews and conversational interfaces.

Since Google introduced the Knowledge Panel in 2012, engagement has been shifting away from publisher destinations toward answers delivered inside the search interface itself. With the rise of ChatGPT and AI-native search models, that trend has accelerated.

He explained that “the space that media owners are operating in seems to be getting smaller because of the capabilities of this technology.”

Besides fewer clicks, the bigger threat is the disintermediation of publishers from audiences at the point of information need.

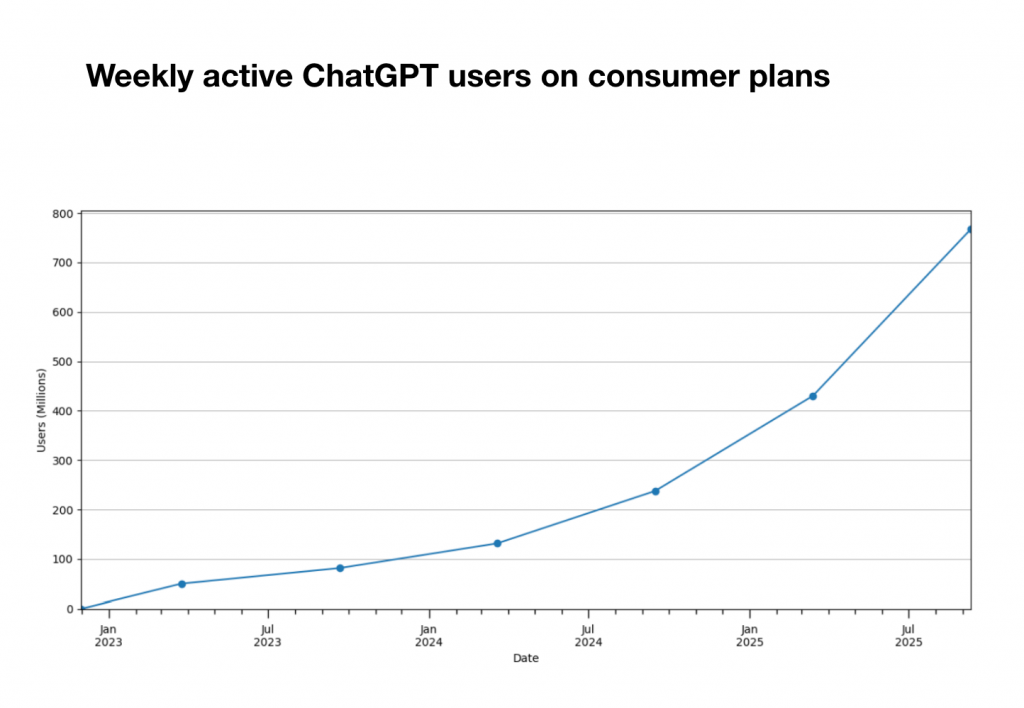

OpenAI’s own data shows:

But the most important insight for publishers:

“Absent of a licensing deal… referrals you can expect back from these platforms are extremely limited.”

OpenAI’s click-through rates to publisher sites are a tiny fraction of the 9% benchmark for top organic Google positions. In short, readers get what they need inside ChatGPT and almost none of them click through to the original source. Unless licensing economics improve dramatically, David warned that publishers risk losing discovery and traffic simultaneously.

While a handful of major publishers, including The Financial Times, AP and Axel Springer, have begun striking licensing deals with OpenAI, these agreements currently cover only a small slice of the industry and don’t yet compensate for the traffic being lost as users increasingly stay inside AI interfaces.

Faced with real competition for the first time in two decades, Google has accelerated product releases:

Google’s objective is simply to stop query leakage to ChatGPT, with Buttle describing Google’s strategic bind:

“It can’t move as quickly as it might want to… because of consequences on its core business model.”

Rolling out an AI-native interface at scale would erode Google’s own search ad revenues and dramatically weaken publisher value exchange. As a result, Google is experimenting cautiously while shifting traffic toward Google Discover, which now represents around 70% of Google traffic to publishers.

But Discover traffic is lower quality, less engaged, and poorly aligned with publishers’ subscription and habit-building strategies. And crucially, visibility is tied to how much content publishers allow Google to ingest for AI purposes. For many news organisations already struggling with platform dependency, this creates a dangerous loop.

In the short term, publishers can’t control how quickly Google rolls out AI-native search, but they can reduce their exposure to it. That means shifting focus toward channels where they own the relationship: apps, newsletters, direct traffic, and logged-in experiences.

It also means being far more intentional about what content Google can crawl, how it is reused in AI surfaces, and how that aligns with long-term value rather than short-term visibility.

Ultimately, resilience comes from strengthening owned-and-operated products, building habitual audience behaviour, and reducing reliance on traffic sources that are becoming both volatile and less rewarding.

An important shift Buttle highlighted is that “people are placing new types of queries – complex, compound queries – that didn’t exist in a pre-AI world… and those queries overwhelmingly go to ChatGPT.”

These are high-intent information needs that previously brought users to explainers, analysis pieces, service journalism and evergreen guides. Now, those same needs are often resolved inside AI interfaces, cutting publishers out entirely.

This directly threatens one of the main revenue drivers for consumer and lifestyle publishers, and it’s now starting to affect news organisations as well.

A year ago, Buttle predicted the outcome might be a fragmented market with many specialised AI assistants. Now, he is less optimistic, stating that “there isn’t this ecosystem of AI applications getting real traction in specialist niches… so I’m less hopeful than I was.”

The likely reality:

For publishers, a concentrated market reduces leverage and increases dependency – unless collective licensing and IP protection strategies emerge.

During the Q&A at the end of his session, Buttle made it clear that Apple cannot remain “just a hardware company”. Currently, its AI play is still unclear, and its ecosystem power could reshape distribution again.

However, he was sceptical about ChatGPT’s SDKs as a viable publisher channel, saying that “publishers want to drive engagement on whole articles – not summarised versions inside a chatbot.”

This aligns with a growing industry view that AI interfaces are consumption layers, not loyalty layers.

Do not assume Google traffic will stabilise. The safest strategy is to:

Data shows:

Publishers need a content mix insulated from zero-click outcomes.

Buttle stressed the need for collective action:

Publishers who do not protect their IP now may find negotiations impossible later.

The new discovery environment rewards publishers who own the relationship, not those optimising for fleeting search traffic.

This is the strategic shift we’ve been supporting publishers on – building durable, repeatable audience engagement inside mobile apps.

Buttle’s session was sobering but energising – a call to action for publishers navigating the most significant disruption to our industry since the rise of social platforms.

AI is reshaping what discovery means. It is rewriting distribution economics. And it is forcing publishers to return to what matters most: strong direct relationships, clear value propositions and loyal users who choose to come back.

News

News

News

News