Newsletter

Newsletter

Using the Reuters Institute’s crystal ball, we look at what publishing leaders are expecting in 2023 including their business, platform and product plans.

12th January 2023

In the Pugpig weekly media bulletin, Pugpig’s consulting services director Kevin Anderson distills some of the best strategies and tactics that are driving growth in audiences, revenue and innovation at media businesses around the world.

It’s rare that we’ll focus on one item, but when it’s Nic Newman’s annual outlook for media and technology from the Reuters Institute for the Study of Journalism at Oxford, there are more than enough insights to pore over. And the insights are particularly valuable because he and the research team surveyed 303 news leaders from 53 countries and territories. While the report is focused on the news industry, many of the trends will affect publishers, broadcasters and digital outlets regardless of market focus.

Sign up to get the Media Bulletin in your inbox.

We spoke to Nic for our own State of the Digital Publishing Industry report, and he was one of the voices predicting challenges for media, particularly news media in 2023. While 44% of respondents were confident about their business prospects in the coming year, 37% were neither confident nor pessimistic, and 19% had low confidence in the outlook for the coming year. Print publishers are facing rising costs for paper, ink and distribution, which we heard from several publishing leaders. One leader told us that the cost rises were unsustainable. Nic said that newspapers will slim down their editions, not only the number of pages but also the number of days they publish. And while costs are rising, there is pressure on advertising due to economic uncertainty. Pressures on costs and revenue are never the kind of environment that businesses want.

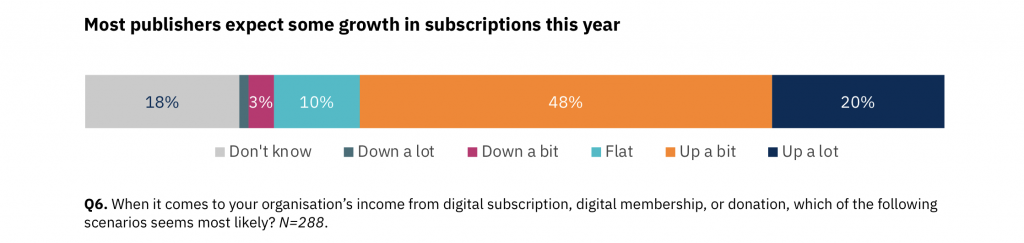

Despite these headwinds, publishers who have diversified revenue streams with strong membership or subscription businesses are generally optimistic about their outlook. The report found that 48% of publishers expect their subscription revenue to be up and 20% expect their revenue to be up a lot.

There will be a balancing act between retaining existing subscribers and attracting new ones through a mix of price cuts, special offers and bundling. Echoing a trend that we have already highlighted, publishers will extend their subscription offering by bundling games, podcasts, newsletters and lifestyle content, the report found. Publishers, such as Le Figaro, will be looking to copy the New York Times’ playbook that has extended their subscription offering through new content, acquisitions and adding existing brands such as cooking to the bundle, the report added.

However, publishers do not want to become overly reliant on any single revenue stream, and the report found that “multiple different revenue streams will be important to them”. Subscriptions continued to increase in importance while advertising was down compared to 2020. Donations, philanthropy and funding from the tech platforms rose, which reflected regulatory changes in Australia, Canada and the EU that pushed Google and Facebook to strike deals with publishers.

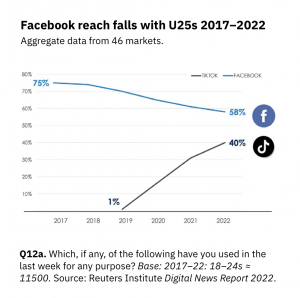

The report also provides some useful benchmarking in terms of where publishers are focusing in terms of their off-platform activities. It probably comes as no surprise that publishers said that they will be spending less attention on Facebook and Twitter and instead focusing much more attention on TikTok, Google Instagram and YouTube. Before I go on, I want to pause and highlight that the search giant is number two on the list of platforms where people will be focusing their attention. Search remains a reliable source of engagement with new audiences. And after Twitter, where will journalist go? Most of those surveyed think LinkedIn.

The report highlighted a drop in reach for under-25s at Facebook and the rapid rise among the same age group by TikTok. The shifts in platforms will lead to a greater focus on video, but it will not be anything like the much maligned “pivot to video” that saw a sharp rise in production and an equally sharp decline. Instead it will be some short-form, vertical video but also mix of other, longer formats as publishers and broadcasters look to move audiences into a deeper relationship with them, the report says. That being said, the “pivot to video” was such an unmitigated disaster that I expect that efforts will be much more considered, and video impressions declined faster than display advertising, according to Gartner marketing analyst Mike Froggatt, which should also give publishers pause when considering a rush back to video.

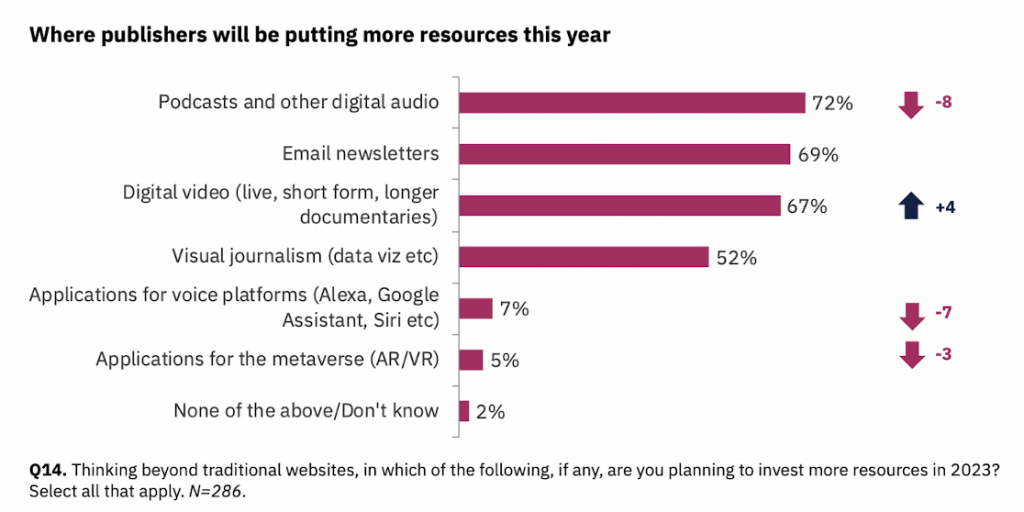

However, carrying on from last year the report says that publishers will be focused on newsletters and digital audio because they promise “the best way to build a deeper connection with audiences and to encourage them to come back more frequently”. In short, they see these formats are driving conversion and retention. One thing to note is that when the report mentions digital audio, it does not simply refer to podcasts but also includes audio articles such as “reporter reads” and even AI-versions of reporters voices to automate the text-to-audio process. One notable area of audio that has seen a significant decline both from the platforms that build them but also from investments from publishers are voice platforms such as Amazon’s Alexa and Apple’s Siri.

Nic said during our interview for our State of the Digital Publishing Market report that that ‘shiny new things’ such as the metaverse and NFTs had fallen by the wayside. It stands to reason during a year that promises uncertainty that these more speculative products are not high on the list of publishers’ priorities.

However, the report said that it was a breakthrough year for artificial intelligence, particularly “generative AI” that can produce text and images using simple prompts, services such as ChatGPT, MidJourney and Dalle-E 2. The report found publishers are using the AI toolkit of machine learning, natural language processing and natural language generation to:

As we found in our survey of publishers, personalisation is a major focus for this year, and AI can help deliver those systems. The technology can also help staff be more efficient, delivering a cost savings while also helping to grow the business by increasing conversion and retention.

Publishers expressed increasing confidence that they were getting better at delivering the right products and improving existing products. However, they were less sure about their ability to deliver these products quickly and even less confident that they had mastered the art of knowing when to end products that are no longer delivering. During periods of uncertainty and change, agility and speed become important capabilities, and they were embracing more agile techniques while also adopting a “more audience-focused approach to product development”, the report said. As we have noted, this includes adopting the user needs and “jobs to be done” models.

To support user needs experimentation, publishers are rolling out private tags that allow them to continuously monitor how content that they identify as meeting specific user needs is performing. Pugpig Consulting Services has recently done work with one of our clients to segment content and track how content intended for different audiences is driving their registration goals.

This year will be challenging. However, he and others have highlighted that media businesses have put in place the people, processes and profit drivers during the turbulent pandemic years to weather storms. In the end, he says, “This could be the year when journalism takes a breath, focuses on the basics, and comes back stronger.”

The report aligns with work that Pugpig Consulting Services is already delivering to clients including automated tagging, content audits to inform product development and efficient newsletter production using our platform. If you want to learn how we can help you too, please get in touch with us at info@pugpig.com.

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter

Newsletter