Newsletter

Newsletter

Publishers’ events and high-end experiences are offering sponsors opportunities that platforms can’t.

22nd November 2023

In the Pugpig weekly media bulletin, Pugpig’s consulting services director Kevin Anderson and digital growth consultant James Kember distill some of the best strategies and tactics that are driving growth in audiences, revenue and innovation at media businesses around the world.

If you want to know more about how we are working with publishers like you, get in touch at info@pugpig.com.

Ad revenue is declining for publishers, heaping more pressure on margins and forcing media companies to make additional job cuts, according to Digiday. “It’s a really tough ad market out there, with pressure on CPMs and an uncertain performance advertising market due to questions about the consumer. Everyone is taking the chance to reset the cost bar,” Daniel Kurnos, an analyst at investment banking firm The Benchmark Company, told Digiday.

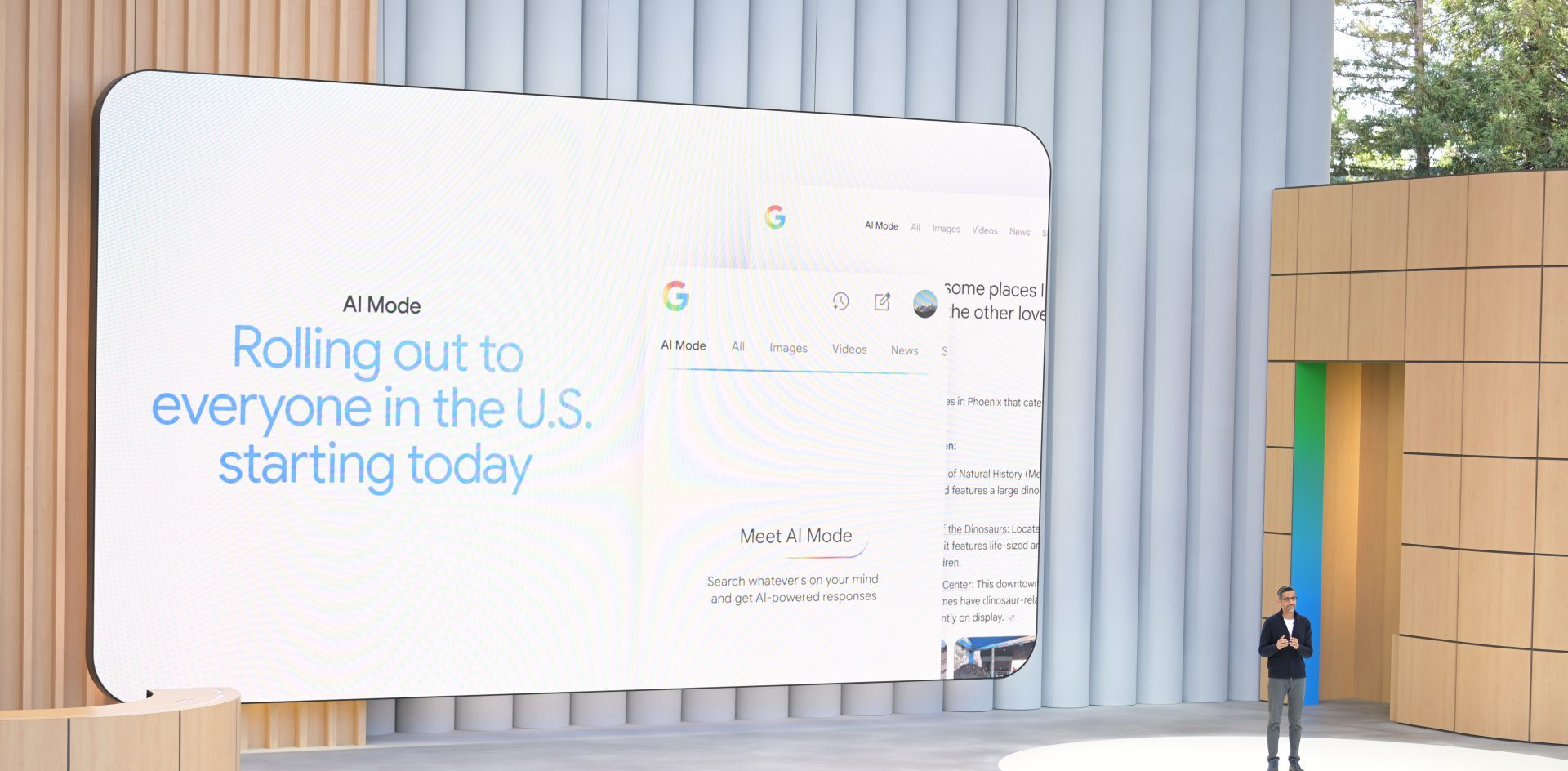

Whereas the Press Gazette had predicted that 2023 would see modest growth in the UK advertising market, all of this went to platforms, not publishers. The end of the Platform Era doesn’t mean that the platforms have lost their market power but only that the social platforms have turned off the torrent of traffic that they used to send to publishing sites. This loss of traffic continues to bite combined with pressures on advertising budgets, with an estimated 8% decrease in advertising across national news titles both online and offline.

Moreover, the macroeconomic conditions driving uncertainty in ad yields are also putting pressure on the subscriptions and print market for some publishers. The Washington Post is making cutbacks due to not being able to hit their advertising or subscription targets whereas Reach plc cited inflation as driving their print costs higher, leading to another round of staff cuts. It’s tough out there.

These are worrying times for publishers who are seeing their long-established revenue streams squeezed, and for some making cutbacks is the only option. However, others are looking to boost overall sales by leaning into additional, complementary revenue streams.

As we highlighted in our recent Retention Economics report, by viewing retention through the lens of relationship management, you can find ways to maximise your returns across the spectrum of engagement, making you less reliant on any single revenue stream. An example of this for loyal audiences, a couple of weeks ago we talked about how Elle created a community to build closer relationships with their most engaged customers and offered, alongside a subscription and newsletters, member-only content, offers and events. The New Scientist is finding that they can earn meaningful revenue from audiences that registered but have not subscribed through their range of events from virtual and major in-person events to science-themed cruises. According to Digiday, publishers are increasingly looking to tap into events via a range of strategies, including “increasing the volume of events and turning their events businesses into standalone brands to turning experiential franchises into pop-up commercial content creation studios”.

Digiday spoke to Jason Wagenheim, president and CRO of BDG, the publisher of Bustle, W Magazine and Nylon. For Jason, events are a way to bring revenue back into publishers by offering “things that Google, Facebook, linear [TV] networks and other big platforms out there just don’t do or can’t do”. The article quoted anonymous media buyers who said that whilst the volume of these types of activities was low, brands are looking at digital publishers as the place to go to spend their experiential marketing dollars.

They cited several examples of experiential activities that are generating significant additional revenue for media companies. For instance, when World of Good Brands was spun off from Leaf Group earlier this year, they made the decision to create a new experiential company: House of Good. Featuring a three-story space in the “heart of Los Angeles”, they are able to deliver roughly three sponsored takeovers a month and are already sold out in Q4 and soon to sell out in Q1 next year, according to CEO Lindsey Abramo.

These experiences are particularly interesting as they are different to the traditional conferences that publishers have been holding for years. They are specifically designed to bring ad revenue back to publishers from the platforms, rather than monetise the audience directly through ticket sales.

However, that is not to suggest that experiential events are the only option going forward. Leaning into successful podcasts, some publishers are hosting live podcast events like The Rest is Politics Live in the UK. As with Elle, their exclusive position within the fashion industry placed them in a spot where they could offer physical access to events as a product and sell it. Many other publishers have had similar successes and are able to generate revenue both through the selling of passes to the events but also through physical advertising. This is especially the case for specialist and B2B publishers. Many have robust award franchises that are rich with revenue opportunities.

However, these new-look events and experiences rely on many of the same components as a successful subscription strategy. Certainly, many publishers still have large-scale events in which make-or-break is determined by the number of sponsors rather than ticket revenue. However, sponsored takeovers and access-based experiences are focused more on engagement with a smaller but more engaged customer who is willing to pay more, delivering higher ARPU. It begins with building a highly engaged, loyal audience. Furthermore, it is crucial to merge audience development with a compelling brand proposition in order to attract sponsors.

To build this engaged, loyal audience, you have to deliver the best product experience aligned with relevant content, and the events you organise should be related directly to your brand and align with your mission, such as New Scientist Live, billed as a grand festival of ideas. Their signature event offers attendees a thoughtfully curated set of talks and “hands-on experience(s)”. Even for experiential offerings, it needs to appeal to your core audience as ultimately, that’s who the advertisers are paying to reach.

In light of the current economic challenges, it is understandable to feel discouraged as many organizations are forced to make difficult decisions, such as reducing staff, in order to navigate rising costs and declining revenue. However, it is reassuring to see the publishers that are identifying opportunities to bring advertising revenue back from the platforms via non-traditional, innovative methods. It is a matter of being creative to consider what types of events and experiences your audiences want and that only you can offer. With intensifying competition for ad and subscription revenue, events and experiences provide a less crowded blue ocean strategic space where publishers can leverage unique capabilities and brands that appeal to audiences and advertisers alike.

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter

Newsletter