Newsletter

Newsletter

Publishers are in a maelstrom of change, says advisor Lucy Kueng, and we outline how to weather it in 2024.

22nd December 2023

In the Pugpig weekly media bulletin, Pugpig’s consulting services director Kevin Anderson and digital growth consultant James Kember distill some of the best strategies and tactics that are driving growth in audiences, revenue and innovation at media businesses around the world.

If you want to know more about how we are working with publishers like you, get in touch at info@pugpig.com.

Change may be a constant in media, but looking back over 2023, the pace of change felt anything but constant. At times, the change felt dizzying, disorienting and disruptive. In speaking with PPA in April, Lucy Küng, strategic media advisor and researcher, said: “I’m amazed by the speed of change in the media world. We are at a pivot point.”

That pivot has included many of the things that we have written about here on the Media Bulletin, such as the collapse in traffic to media sites from social media and concerns about the impact of AI. Of course, this all happened against the backdrop of economic uncertainty. Spiking inflation has hit consumers and increased the cost of inputs for print publishers: paper, ink and distribution. And publishers have executed several rounds of job cuts to compensate for the loss of ad revenue.

While it’s a challenging environment, publishers and broadcasters are finding success. As Lucy added, “If you have a clear vision and visceral understanding of your audience and how to enrich their lives, there has never been more opportunity.” As we look back over 2023, we’ll look forward to how you can succeed in 2024.

Lucy calls the current environment a “maelstrom of change”. Even in the best of times, one of the biggest challenges that media leaders face is setting priorities. When everything feels like it is on fire, it becomes even more difficult to know which fire to fight first.

Fortunately, the Financial Times has been spreading its strategic framework of setting a North Star goal and then determining outcomes, hypotheses and experiments that flow from the goal. It can keep leaders and organisations anchored during times of great change and uncertainty.

Media companies are using this strategic-level goal setting to align their teams and transform their organisations. Product managers or just the diffusion of product thinking is helping organisations large and small set priorities more effectively. On the tactical level, publishers are developing data abilities and testing capabilities that inform decisions and drive experimentation.

Whether you’re using the FT’s North Star framework or another goal-setting methodology, there are a few key things to remember.

However, we want to make another observation. Some media companies developed tactical agility but failed to re-examine strategies that ceased to be relevant for the media market. And 2023 showed the price of strategic paralysis as media companies that pursued volume over value strategies failed to adapt as the media markets changed. We saw this with the collapse of BuzzFeed News but also the ongoing challenges facing newspaper groups in the US and UK. Their goal was to reach the largest possible audience using audience development methods reliant on search and social and monetise these audiences using advertising.

2023 delivered multiple blows to this strategy. After the pandemic lockdowns, media consumption trends that spiked during the COVID-19 pandemic returned to the mean, creating an attention recession. The year continued years of declines in the volume of traffic that social media sent to media platforms sent to media sites, particularly news sites, leading to the end of the Platform Era. And economic uncertainty meant advertising revenue was soft, a trend which is forecast to continue into 2024.

As we pointed out several times over the year, the decline of platform traffic to media sites and its overall volatility is not new, beginning in the middle of the last decade. BuzzFeed’s CEO Jonah Peretti admitted that he failed to push the company to adapt to changes in the market. But there are plenty of media companies that have chased scale not only through platforms but also acquisitions. In 2024, they will be forced to re-examine their volume-over-value strategies. Exhibit A is Mail Online exploring a freemium paywall.

Let’s be frank. For many ad-reliant volume businesses, content wasn’t king. They relied on traffic tricks and ad stuffing that made sites unusable and diluted brands. Many sites became addicted to revenue from “content marketing” farms that loaded the bottom of their pages with low-quality, unrelated ads for content or products.

Volume players will need to re-visit not just their tactics but their strategies in 2024. For many of them, time is running out.

With the decline in social traffic, 2023 was also filled with anxieties that other traffic and engagement drivers might also fail.

As the temperatures have dropped, some publishers have been worried that we’re entering a “newsletter winter”, and we saw some major newsletter brands struggle in 2023. Axios Local paused its expansion, and theSkimm, which started as a newsletter for millennial women in the US, just announced its third round of layoffs this year. But looking a little deeper, the picture is more complex. As Adweek’s Mark Stenberg points out, theSkimm is “one of the last premium newsletter companies of the 2010s to remain an independent operation”. In the US, it might mean that publishers launching with newsletters as an MVP will have to have diversification plans in place much earlier in their development than in the past.

However, it still seems quite sunny for established publishers who are using newsletters as part of their product mix. And the mix is what is important. As we often highlighted this year, the New York Times found that multi-product subscribers have 40% lower churn, and in the UK, The Telegraph has found that newsletter subscribers are 50% more likely to continue to be subscribers after 12 months.

Managing a diverse but complementary product portfolio and bundling was another important theme in 2023 that seems to become even more important in 2024. Even for those publishers on the value path, 2023 offered up its challenges, but as Esther Kezia Thorpe wrote in the Nieman Lab predictions a year ago, subscription businesses drive product innovation, align the products much more in line with readers’ interests and build out product portfolios to capture revenue beyond their most engaged audiences.

While social has been declining as a source of traffic, traffic from Google has been relatively durable, apart from dips due to algorithm changes. However, Facebook wasn’t the only platform going through a ‘divorce’ with media, particularly with news publishers. Google threatened to turn off the traffic tap to news publishers in Canada until they struck a deal with the government in late November.

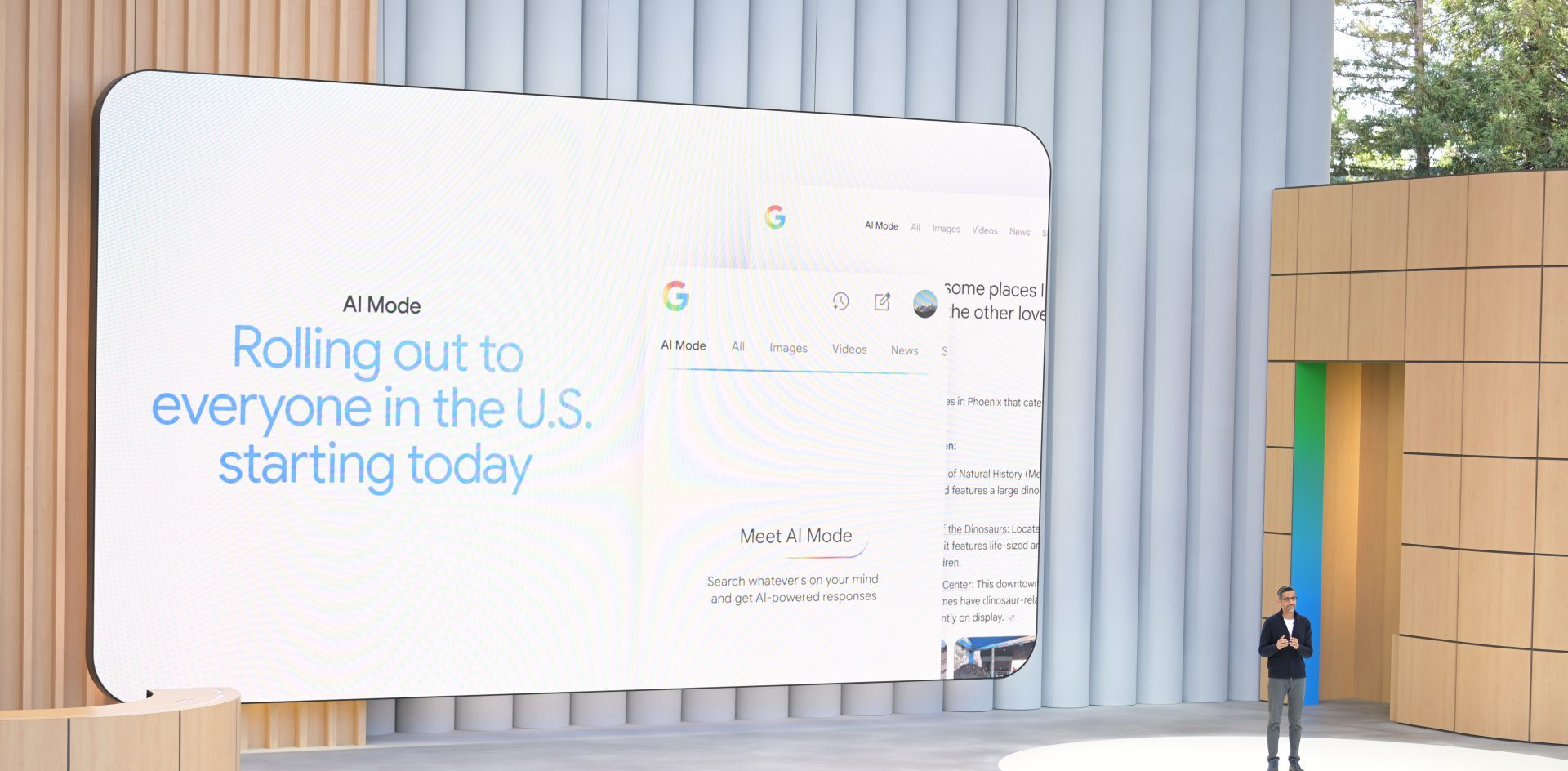

Apart from regulatory issues, publishers have been worried that Google’s AI, Bard, would answer users’ questions without the need for them to come to their site. A study by The Atlantic found that Google’s “Search Generative Experience” satisfied users 75% of the time, meaning that they didn’t need to carry on to a site.

The response from publishers has been a mix of defence and offence. On the defensive side of things, some publishers worked to prevent large-language models from scraping their content. Others, like Bloomberg and travel business publisher Skift, decided to use special-purpose LLMs to create chatbots of their own. And large publishers including the AP and Axel Springer have struck deals with ChatGPT’s parent company to licence their content and licence OpenAI’s tools.

When it comes to AI or any of these changes, we agree with Damian Radcliffe that publishers need to take time to develop an approach. The approach needs to be consistent with their overall strategy and their values. Things that Damian and we recommend for 2024:

We thank you for sharing some of your time and attention with us this year. We wish you all the very best in terms of your success in 2024, and we look forward to working with as many of you as possible in the new year.

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter

Newsletter