Newsletter

Newsletter

Changes in search could cost publishers billions. We explore SEO and app tactics publishers will need to adopt to weather this storm.

22nd March 2024

Most of our coverage about the end of the platform era has focused on the long, slow divorce between social media and news publishers. Lingering in the background has been the anxiety publishers have about changes in search, the other pillar of off-platform-based audience acquisition strategies. Central to these fears were concerns about how AI might disrupt search traffic, which is only one change related to search. Changes in consumer behaviour, especially amongst young audiences, have reshaped how audiences find information. We are now getting data about the scope of these changes and what they could mean for publishers, and it underscores and clarifies the nature of the challenges.

Of course, at Pugpig, we think deeply about how market changes relate to the role of apps in publishers’ strategies. For most publishers, apps sit further down the conversion funnel from the awareness and user acquisition activities where social media and search sit. As we have written about before, most users from social platforms were only loosely connected to publishers. With all of these changes, there is an imperative to develop deeper relationships with a smaller, higher-value audience and reduce reliance on advertising revenue. As Ben Werdmuller, CTO of The 19th, has said, “Owning (consumer) relationships will no longer be a choice; it will be a matter of survival.”

Based on data from the apps on our platform, the largest group of users are those with access to the app based on an existing subscription, part of a digital or digital-print bundle. While our data also shows that most publishers view the role of apps as one of subscriber retention, there is also a role that they can play in terms of converting anonymous users to known ones through newsletter sign-ups and registration journeys in the app. And some publishers are starting to see apps as part of their user and subscriber acquisition efforts. With these changes in search, developing these user acquisition efforts via apps takes on greater urgency.

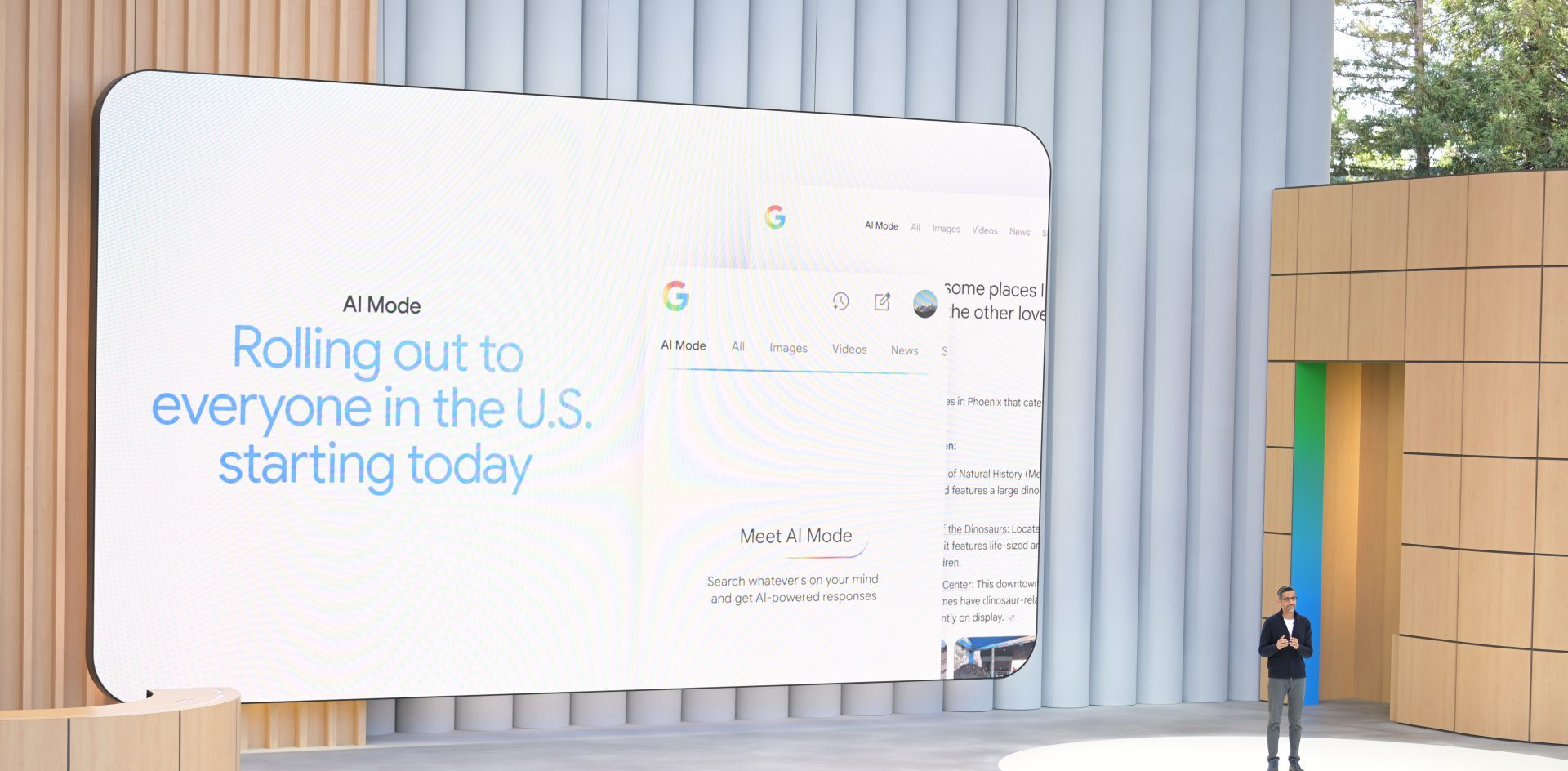

Publishers have been anxious about what impact AI would have on search traffic. The fear has been that the new chat-based experience will mean that audiences will get the information they need from Google without the need to visit publishers’ websites or use their apps.

Now, Adweek has numbers about the potential impact on traffic and revenue as Google’s Search Generative Experience is developed. The headline numbers are scary, with predictions of declines in organic search traffic ranging from 20% to 60% with a potential ad revenue loss as high as $2 billion annually across the publishing industry.

However, Google has cautioned that SGE is still in development and the final product could be different from the version that we’re currently seeing. The company told Adweek it would be “premature to estimate the traffic impact of our SGE experiment as we continue to rapidly evolve the user experience and design, including how links are displayed”.

But the industry isn’t standing still. Some bigger publishers are trying to mitigate the risk by attempting to fight, or work with, the AI platforms. Germany’s Axel Springer and the Associated Press have signed licensing deals with OpenAI, whilst the New York Times has filed a suit against Microsoft and OpenAI for breach of copyright. For many smaller publishers, a more pragmatic approach will probably be necessary. They’ll need to retool their SEO strategies if they are to continue to benefit from traffic from Google.

Adweek offered some examples of how this can be done. Firstly, they highlighted Money.com, which is reworking articles into a question-and-answer format. They are producing snippets of content that answer questions related to a product or service. According to Katie Tweedy, Associate Director of SEO and Content Marketing at Collective Measures, it’s also “important to try and get into the SGE result, as well as to rank for those things that SGE isn’t showing”. Traffic for the most popular queries is likely to shrink, so aim to rank for questions that SGE has not answered, she suggests. Otherwise, paid search and paid social are options for publishers, but paying for advertising to sell advertising will have a significant impact on margins.

Google’s SGE is not the only change in search. SGE is an attempt to remain relevant as other services such as OpenAI’s ChatGPT and Microsoft’s Copilot have risen to challenge Google’s dominance. But Google also must try to win back users, especially amongst Gen Z, who are shifting to other platforms such as TikTok for their information needs. TikTok threatens two of Google’s major projects, search and YouTube.

Just as Google introduced new behaviours when it launched, young digital consumers are getting their information needs met via video tutorials that contain product reviews and “personal anecdotes” about products and services. In a call last week, Jason Hartley, Head of Search & Shopping and Privacy Lead at agency PMG, addressed the impact of TikTok on Google search. Jason believes that TikTok is “ingrained” in the behaviour of younger readers and his agency has observed the syphoning off of Gen Z from Google. According to the latest data, “about 73% of Gen Z prefers to start on TikTok than Google”. TikTok users are using the app for music, cooking recipes as well as DIY and fashion tips, according to eMarketer.

It remains to be seen how widespread the impact will be going forward on Google, but it’s likely to guide the company’s strategy into the future. As is demonstrated through their Search Generative Experience and YouTube shorts, Google will continue to learn from competitors and attempt to keep more users on their platforms for longer. Whatever the outcome, publishers’ traffic is under threat. Like SGE, TikTok poses a threat to traffic to publishers’ sites and apps by providing all of the information that users need without having to leave the app.

So what can publishers do to mitigate the risk of Google’s Search Generative Experience and the rise of TikTok? There is no silver bullet to replace the traffic that used to come from Facebook and is increasingly less likely to come from search (TikTok’s never been a prominent traffic driver).

Publishers need to adapt to a world where they focus on higher ARPU from a smaller audience. As Brian Morrissey wrote in his newsletter The Rebooting:

“The current ‘big’ opportunities in publishing – commerce, subscriptions, events – are often not the kind of massive markets as advertising used to be for publishing when it had far less competition – and far more traffic,”

To take advantage of these opportunities, publishers need to focus on developing habit and loyalty with their existing audience and maximising every engagement to increase ARPU. Ultimately, KPIs should shift from page views to engagement, quality reads and conversion. Ad revenue will benefit from this strategy, but it is unlikely to make up for the dropoff in traffic. Therefore, subscriptions and new revenue streams will continue to increase in importance.

Moreover, as we’ve discussed, several publishers are looking at new products to build deeper audience relationships and monetise users. Elle is building communities around events whereas New Scientist Live has been created and billed as a grand festival of ideas. Elsewhere, The Dear Media podcast network has worked with influencers to create podcasts and also provided support with branding and lucrative brand extensions beyond content. And some are taking an innovative approach to rethinking their current products, building bundles of existing titles to create dynamic premium experiences.

At Pugpig Consulting, we help our customers optimise their digital products, especially their apps so they better serve audiences’ needs. For some of our customers, their apps serve primarily as a retention tool, they encourage their subscribers to download and continue to drive usage through push notifications and deep linking into articles from social, web and email. For others, their apps are a key part of their subscriber acquisition strategy, encouraging downloads by registered or even unknown users. The role of apps in an anonymous-to-known strategy has been enhanced by the development of external link entitlement, which allows publishers to continue to own the direct relationship with the user, even if the subscription journey begins in the app.

Therefore, the options for publishers are threefold and not mutually exclusive:

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter

Newsletter