Newsletter

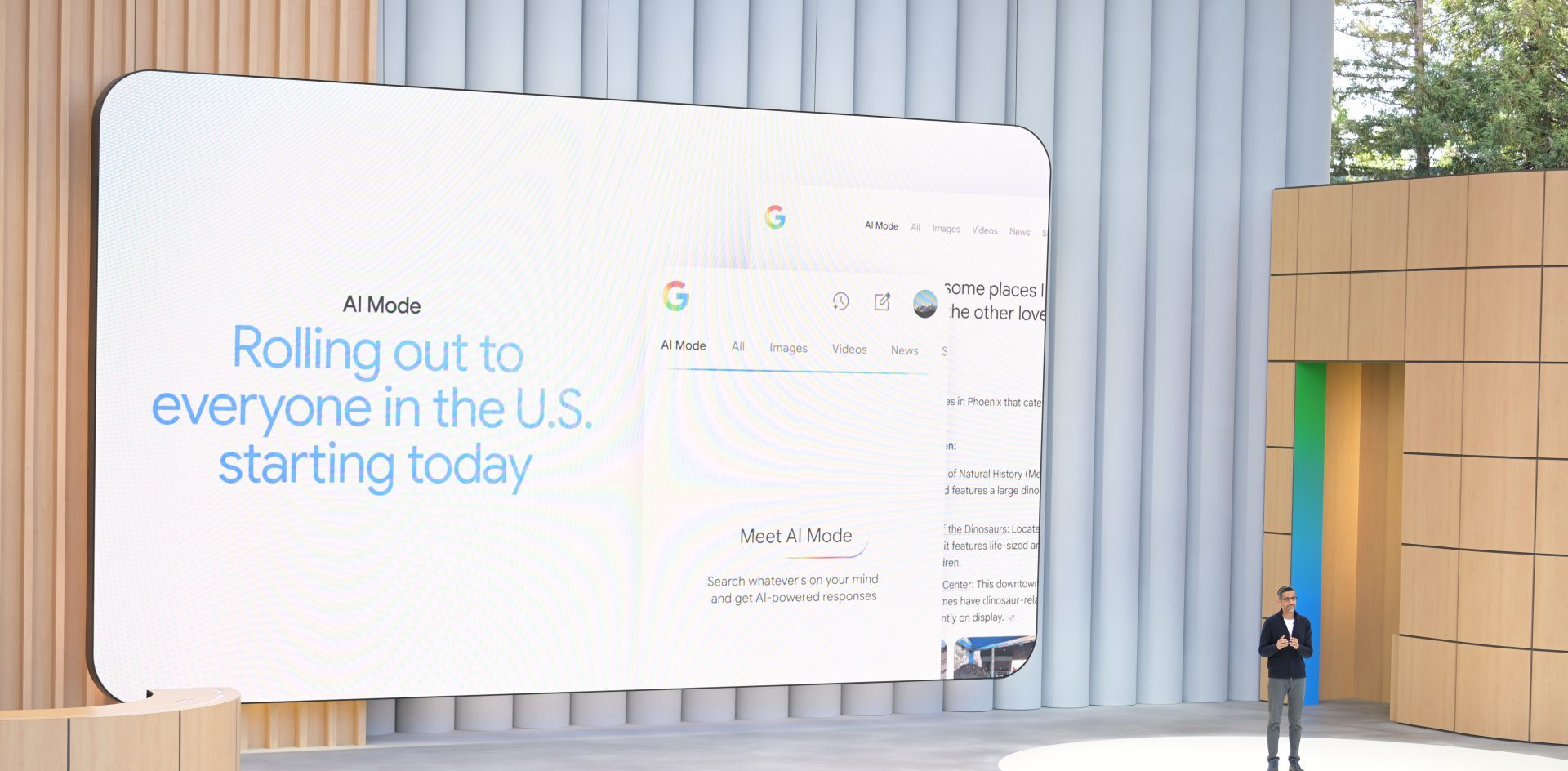

Newsletter

We review the range of ways that apps can contribute to higher average revenue per user including acquiring new paying users.

22nd September 2023

In the Pugpig weekly media bulletin, Pugpig’s consulting services director Kevin Anderson and digital growth consultant James Kember distill some of the best strategies and tactics that are driving growth in audiences, revenue and innovation at media businesses around the world.

We are working with a number of publishers to develop their app strategies both for new product launches and for increasing user acquisition using their apps. If you want to talk about how we can help you, please email us at info@pugpig.com.

By Kevin and James

For news publishers in the US, the volume of digital subscriptions will overtake that of print in 2024, according to a forecast by Mather Economics. However, the crossover for digital revenue overtaking print revenue won’t happen until mid-to-late 2025 based on their benchmarking data. Across the industry, while digital subscriptions are 40% of total subscriber numbers for news publishers, they only make up 20% of revenue. The reason is that the median print newspaper subscription is currently $28.54 per month, whilst the median digital subscription price is just over $9. They calculated that even once the much higher operating costs for print subscriptions are factored in they still have a higher profit margin than digital subscriptions due to the price being more than three times higher. Given the structural decline in print and hybrid subscription revenue, this change will come too late for many publishers, who will find themselves increasingly struggling. You only have to look at the bankruptcies and newspaper closures in Canada announced this week to get a sense of the urgency required to execute the digital transformation of publishing businesses, particularly for local news publishers.

Mather’s primary suggestion (and the entire basis of their econometric approach) to improve digital ARPU is centred on a dynamic pricing model, which has the ability to raise average rates whilst also reducing churn. This is achieved by applying strategic pricing at the point of renewal or at the end of the subscriber’s promotional period. They also suggested looking to optimise the up-front acquisition price, which they stated is effective at maximising lifetime value. This makes sense, as it should reduce some of the heavy lifting done at the end of the initial subscription period. However, they do point out that the capacity to personalise offers can be limited due to the lack of information that a publisher can have about a user before they’ve engaged.

However, pricing is just one (very important) component of increasing digital APRU and whilst we’d recommend having a look at Mather’s posts on market-based pricing it relies on a publisher being able to build a relationship with their audience to gather the data required for the pricing model. Moreover, a more highly engaged audience will be significantly more likely to pay a higher renewal price. It’s essential to build a strategy to encourage higher audience engagement.

Building loyalty and habit amongst your audience is core to our offering at Pugpig Consulting, and at the start of the summer we discussed the Washington Post’s approach to digital engagement where in additional to the discussing the Post’s tactic of highlighting subscriber benefits via dedicated emails we suggested digital onboarding, newsletter signup, bundling, personalisation, retention messaging and app usage in our list of the key activities that a publisher should use to improve audience retention.

Moreover, last year we published our State of Digital Publishing report in which one of our key findings was that apps are super sticky, with the number of sessions and length of engagement significantly higher than on the web. Therefore, the approach to improving digital engagement and thereby providing the data for dynamic pricing is to build an app experience that’s optimised and engaging for the user and to incorporate your app into your overall audience engagement strategy.

Data from Statista has shown that between 2017 and 2022 the amount of revenue generated by news and magazine apps almost tripled and is forecast to almost double again by 2027.

Publishers are leveraging apps in increasingly diversified ways to increase engagement, retention and digital revenue. Apps can act as an entry-level, brand-building experience; they can enhance the offer to include all of the subscribers’ products; and they can play an important role in retention.

Traditionally, publishers viewed apps as the product that was purchased as part of the subscription, and to some extent this remains the case. Pugpig proprietary data shows that largest audience segment for the apps we build consists of those who receive the app as part of a subscription bundle. However, increasingly, publishers are integrating apps into a multi-step process of converting unknown users to known users via registration and then converting a subset of those registered users to subscribers. This provides them with data critical for the type of subscriber pricing models that Mather advocates. However, even if a user is satisfied with remaining a registered user, known but non-subscriber users still have higher level of engagement and provide more revenue opportunities than unknown users. We are seeing a growing number of apps helping to build deeper relationships with audiences and opening up additional revenue opportunities like marketing other products, such as events, to registered users. As we often have noted here in the Media Bulletin, The Independent has found with their A2K – anonymous to known – strategy that registered users are 11x more engaged than anonymous users.

Apps in the news and magazine product category are becoming more diversified as well, as publishers look to serve specific audiences or create products that appeal to audiences at different price points with curated propositions. At Pugpig, we have seen Archant have great success with Pink Un, an app for fans of Norwich F.C. The team was already creating great content for Norwich fans but struggling to monetise it via indirect means using advertising or on platforms they didn’t own such as Facebook and YouTube. They decided that an app was the best way to leverage the great content they were creating to generate revenue directly. The passionate fans are highly engaged with the app, with 48.53 sessions per user per month, and that high engagement drove an 82% trial-to-paid subscription conversion in the app in the months after launch.

In March 2022, the Financial Times launched FT Edit, a slimmed-down app offering eight articles a day. It’s been a hit and within a year of launching had already amassed 140,000 downloads. It follows in the footsteps of The Economist which back in 2014 launched Espresso with the similarly stated aim of appealing to new audiences by offering a version of the news which could be consumed in under 5 minutes. Both apps protect the publisher’s core product by serving as supplementary, entry-level experiences.

For the FT and The Economist their digital subscriptions are reasonably expensive (the FT digital product costs up to £55 a month), but these two apps allow them to offer a light version while maintaining the subscriber journey and pricing of their core apps. The primary advantage of this approach is it builds up brand affinity and serves as an introduction to content allowing the user to sample the product and hopefully step up to a full-priced subscription. Of course, it would be possible for content to be served on the website or via a newsletter, but the benefit of leveraging a standalone app is the ability of an app to build habit and loyalty. And while similar experiences can also be achieved via metered paywalls, registration walls or trial offers, these curated apps have the added benefit of direct, recurring revenue. And these successful products prove that apps can be an acquisition tool, not just a way to serve your most loyal existing audiences.

Apps also play an important role in delivering the user experience that mobile audiences expect. Mobile sites are quite slow. According to Tooltester, the average load time of a mobile page is almost 9 seconds. Conversion drops 4% for every additional second of site load over five seconds, according to Portent. Conversely, for a site or app that loads in a second versus five seconds, conversion rates are 3x higher. Poor mobile web user experience results in a user being more likely to bounce and less likely to read the content they’re looking for when on a mobile site versus an app. The fact is that webpages are often built for desktop first and mobile second and have to work for both within the same environment. Apps, however, are a dedicated mobile experience. This translates into mobile websites having the highest churn rates amongst digital experiences, while apps have the lowest, according to research from the Medill Spiegel Research Center at Northwestern University in the US.

Moreover, apps are a valuable engagement tool. For push notification provider Airship, one of the main advantages of using an app is the ability to reach the “prime real estate” of a phone’s lock screen, which is the most visible and attention-grabbing space on the planet. This is a unique feature of an app, which allows for a publisher to push out relevant, personalised, content to a user to re-engage them with the product. Having these multiple touch points throughout users’ day is another key element in a proactive retention strategy.

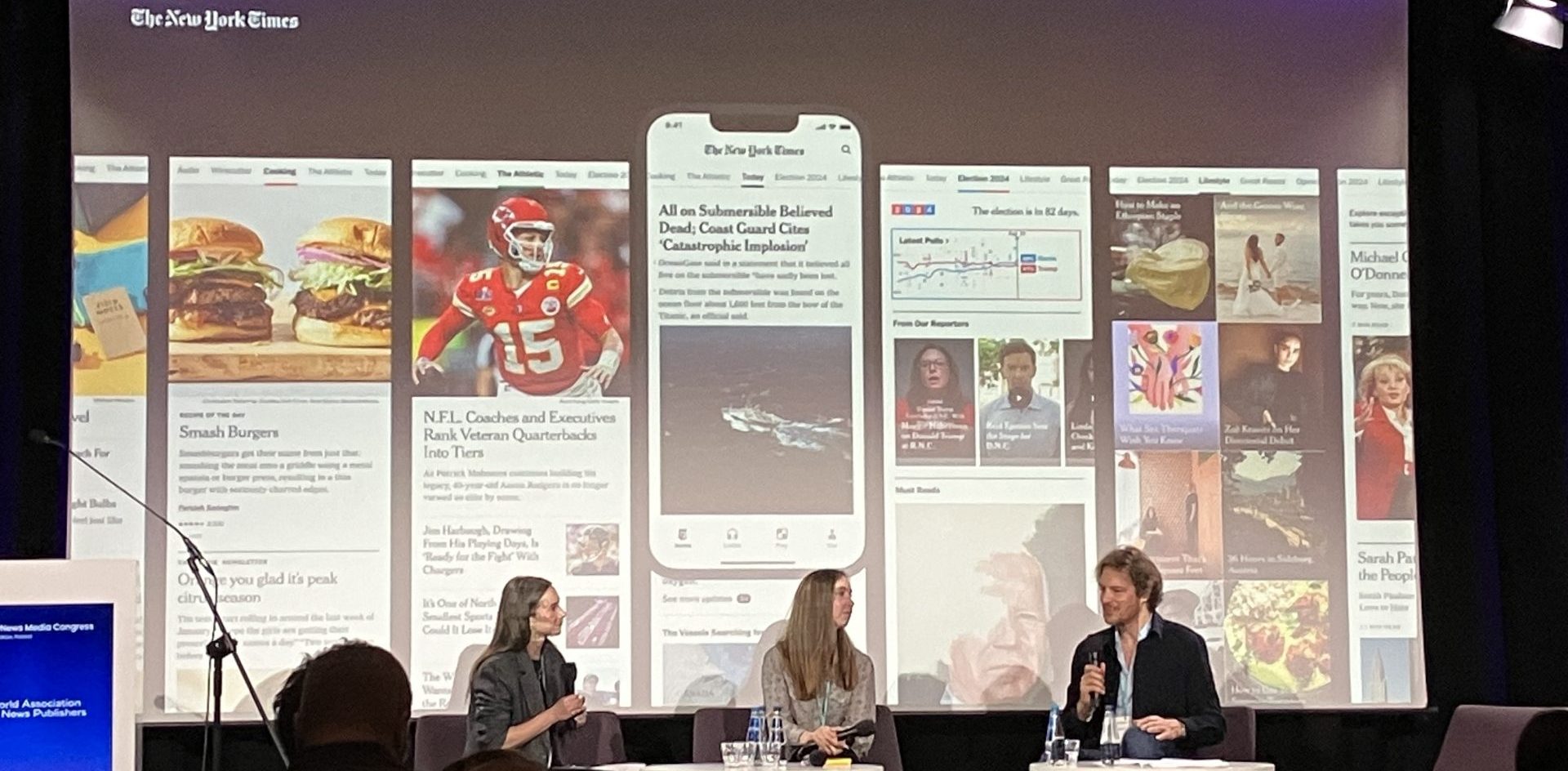

And as the New York Times has found, “multi-product subscribers pay the most and retain best,” New York Times chief product officer Alex Hardiman told Axios. These valuable users have a 40% lower churn rate than single product customers. And publishers have found that the most engaged users are app users.

Overall, apps will play an increasingly important role for publishers, who are going to need to increase their digital ARPU soon to mitigate the fall in print revenues. Of course, they are not the only solution, building a dynamic pricing model, a good overall mobile experience and experimentation to constantly optimise your acquisition and conversion journeys are vital components as well. However, apps have unique features that don’t exist elsewhere to build strong brand loyalty and develop the habits that support retention. As publishers become more sophisticated in their product strategies, apps are playing an important role in converting anonymous users to known ones and in acquiring new paying users as well. That is an important contribution to increasing digital ARPU and bringing forward the day when digital revenues will not only be more than print revenues but meaningfully offset the decline in print revenues.

Here are some of the most important headlines about the business of news and publishing as well as strategies and tactics in product management, analytics and audience engagement.

Newsletter

Newsletter

Newsletter

Newsletter

Newsletter